Managing Payments

Learn how to add your payment information, track your payments and how payments at Medcase work

We are excited to introduce the Tipalti Suppliers Portal as a new way for tracking and managing payments, and your payment details. Here’s what you need to know to get started. If you have not received an invitation, kindly contact support.

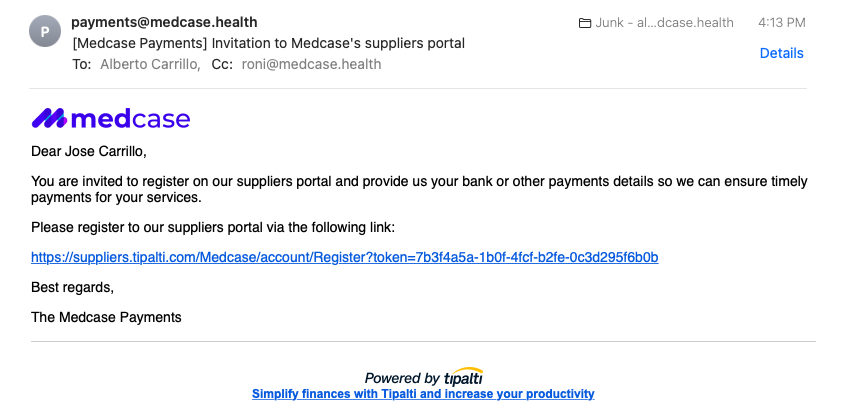

Step 1: Onboarding Email

- You will receive an onboarding email from Tipalti. In Case you cannot see it, please check your spam folder.

Step 2: Accept the Invitation

- Click the link provided in the email.

- You will be redirected to Tipalti.

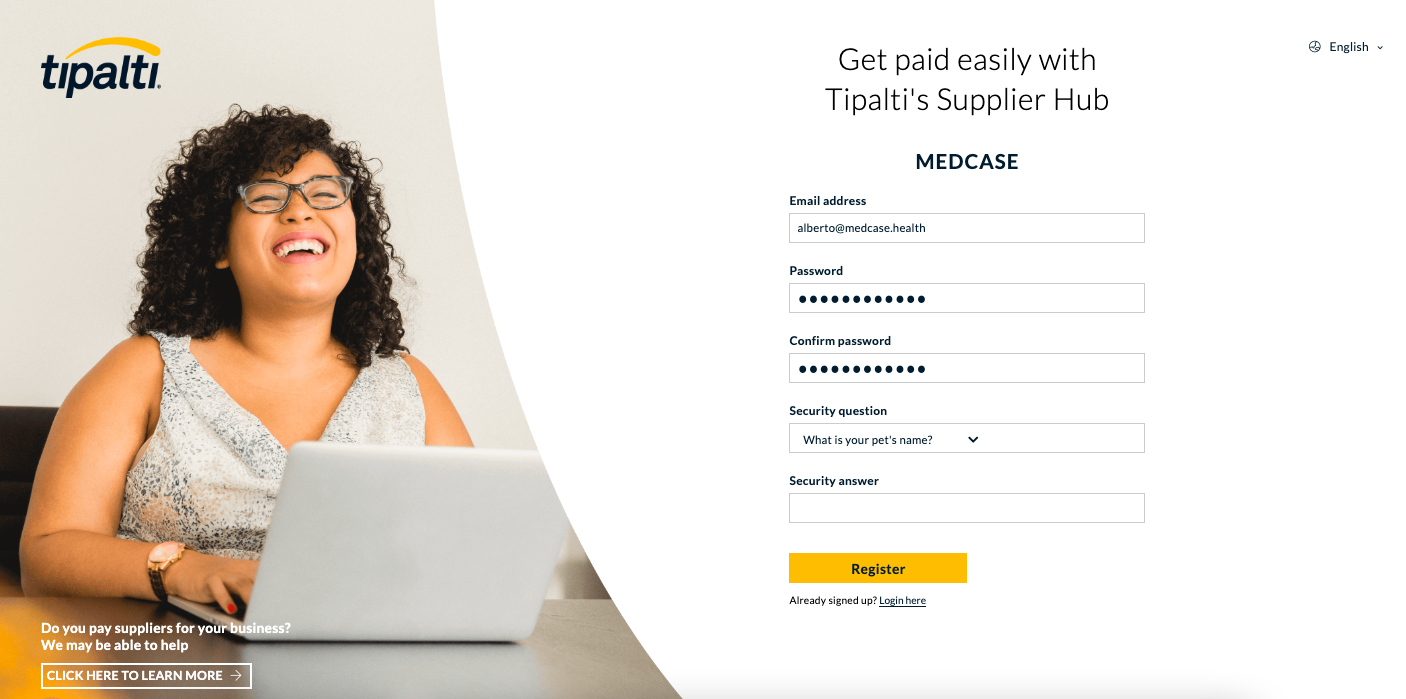

Step 3: Update Your Account

- On the Tipalti site, you can update your existing account details.

- Follow the prompts to complete your account and update your information.

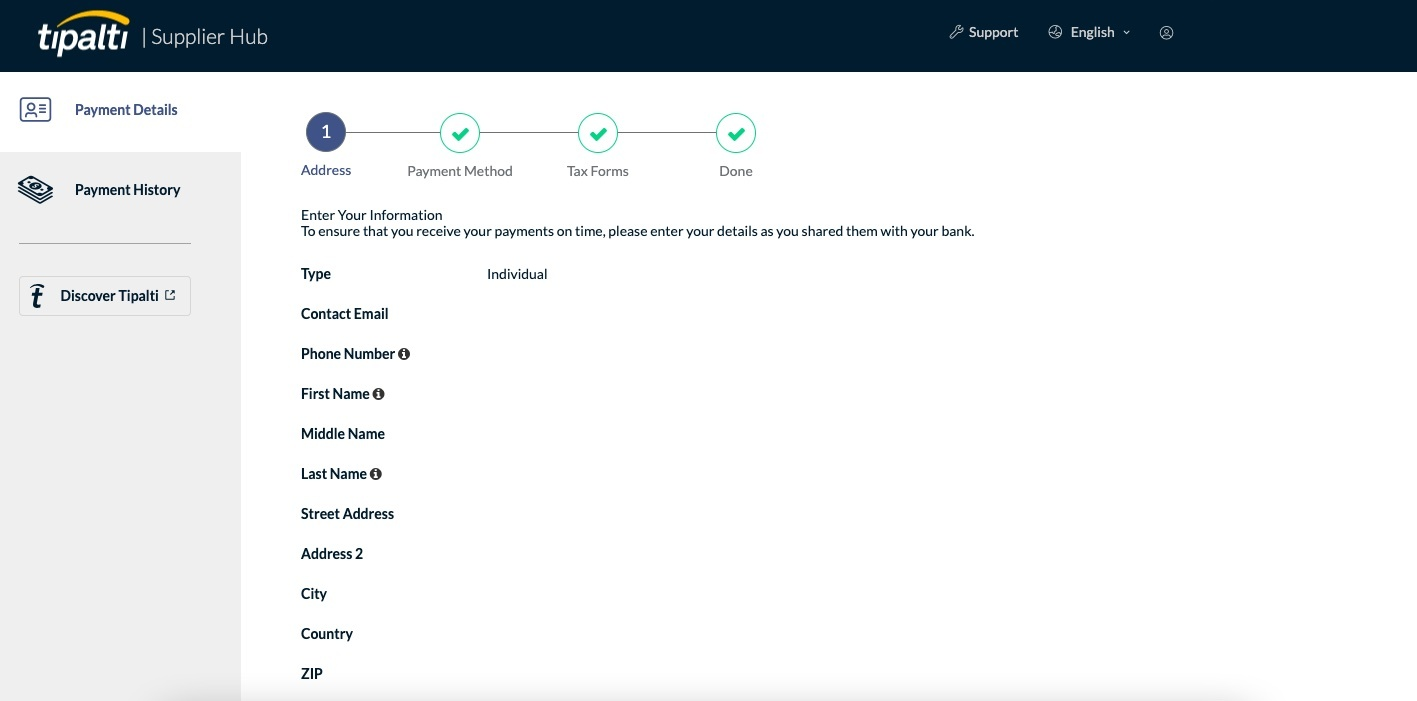

Step 4: Check Your Payment History

- Once logged in, you can view your payment history.

- Navigate to the "Payment History" section to see details of all your transactions.

Log into your Tipalti Account Here. If you do not have access to Tipalti, please email support@medcase.health.

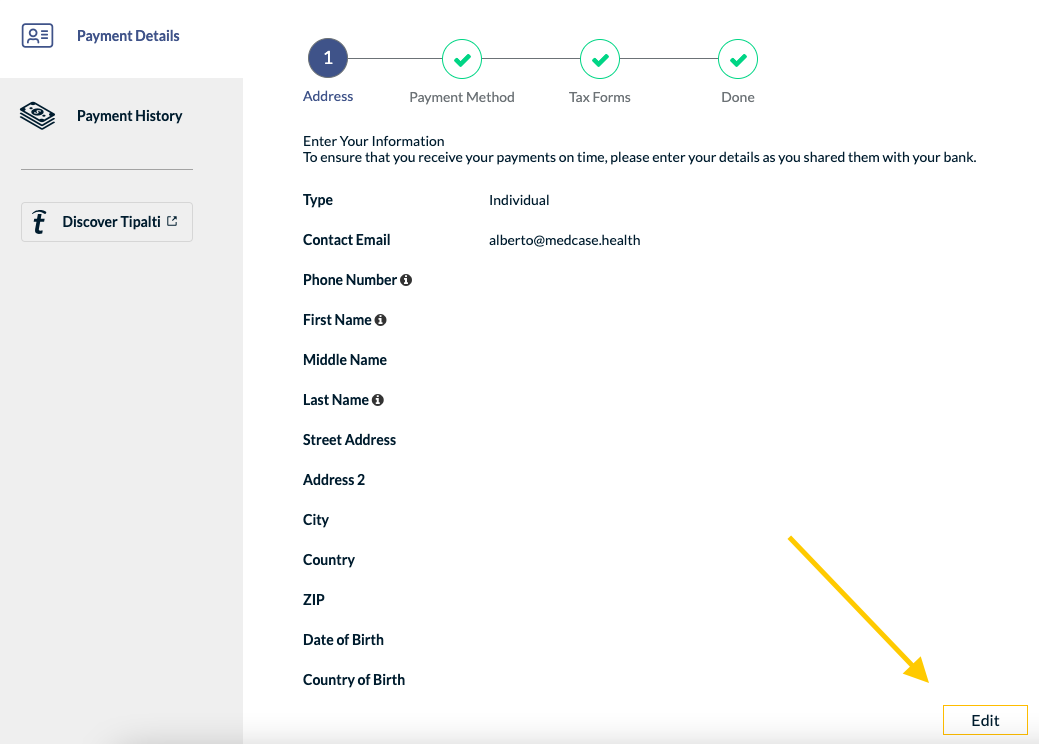

Once logged in, you will see your portal. You can click on "Edit" to add/update payment information including: Addresses, payment method, and tax forms.

Health Care Professionals

Payments at Medcase are, by default, net-30. This means that you will receive payment for all tasks completed during a given month in the following month. For example, if you completed 10 hours of work at $100 per hour in April, You would receive your compensation by the end of May. Generally, we send payments around the end of the month, so you can expect your payment around these dates.

In addition, there are fees associated to the payment timeline. For Net-30, the payment fee is 3.75%.

We also offer the option to choose either of the following payment terms:

Net-10; payment done within the first 10 days of a month with 7% fee.

Net-60; payment done within 2 months with a 0% fee.

You are able to update your preference right in your Medcase profile, within "Invoices".

Note that to receive your payment, you must have completed all required forms in the payment section of your Tipalti profile. Upon completion, you will receive an in-app notification and email notification confirming your payment information has been completed.

Vendors

Vendor payment terms at Medcase are net-60. This means that you will receive payment for your services during a given month within 60 days of the end of the service month. For example, if your invoice is for July services and is presented on August 5th, you will receive payment by September 30th.

Log into your Tipalti Suppliers Portal here.

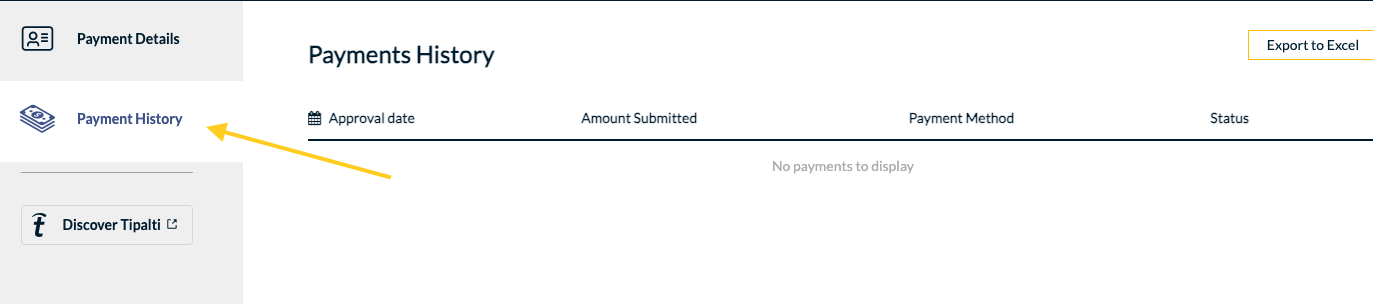

Once logged in, you can see the "Payment History" tab on the left side. It will include a breakdown of every payment you have received from us.

Log into your Tipalti Suppliers Hub here and click on "Edit". If your new details are valid, you will show up as payable.

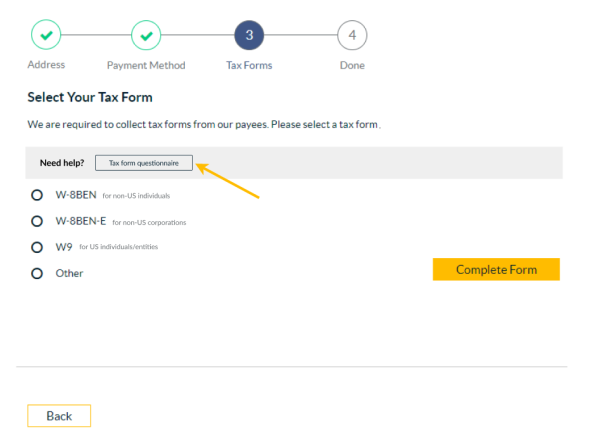

Please refer to the table below or complete our tax questionnaire provided directly in Step 3 of the Payments area, which will help you determine the correct form to complete. Answers are not saved in the system. Therefore, if you exit before completion, you will have to restart the questionnaire.

The following table lists the questions in the tax form questionnaire and the direction of flow based on your answers.

# | QUESTION | IF YES | IF NO |

|---|---|---|---|

| 1 | Are you an individual? | Go to #2 | Go to #3 |

| 2 | Do any of the following apply to you?

| W-9 | Go to #4 |

| 3 | Is the entity formed and registered in the US? | W-9 | Go to #5 |

| 4 | Is your income effectively connected with the conduct of trade or business within the US? | W-8ECI | Go to #6 |

| 5 | Is the entity a foreign partnership, a foreign simple trust, or a foreign grantor trust (not subject to tax in its country of residence and not claiming treaty benefits)? | W-8IMY | Go to #7 |

| 6 | Are you acting as an Intermediary (Qualified or Non-Qualified)? | W-8IMY | W-8BEN or go to #8 (depending on your payer's configuration) |

| 7 | Is the income of the entity effectively connected with the conduct of trade or business within the US (have a trade or business in the US and file US tax returns)? | W-8ECI | Go to #9 |

| 8 | Are you claiming a treaty benefit for personal services performed in the US? | 8233 (depending on your payer's configuration) | W-8BEN (depending on your payer's configuration) |

| 9 | Do you represent a foreign government, an international organization, a foreign central bank of issue, a tax-exempt foreign organization, a private foreign foundation, government of a US possession claiming the applicability of section(s) 115(2), 501(c), 892, 895, or 1443(b)? | W-8EXP | Go to #10 |

| 10 | Do any of the following apply to you?

|

Are you a health care professional with questions? Contact one of our teams below for answers.

| General Inquiries & Support | support@medcase.health |

| Open Positions & Recruiting | recruiting@medcase.health |

| Payments | support@medcase.health |

| Projects | Please email your Project Manager |

Medcase supports 6 global payment methods from around the world, including:

- US Direct Deposit / ACH

- Global ACH (eCheck) / Local Bank Transfer

- PayPal

- Wire Transfer

- Paper Check

- Prepaid Debit Card

DISCLAIMER: Medcase is not a tax advisor and is not authorized to provide tax advice. Any tax-related information posted in the Medcase Help Center is not intended nor should be construed as tax, legal or investment advice. If you have questions about tax-related issues, please consult with a tax professional.

If you are an Individual residing outside the United States of America with a valid Tax Identification Number (TIN) for your country of residence, you will be prompted to fill out ONE of the following forms:

- Form W-8 BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding

- Form W-8BEN-E, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)

- Form 8233, Exemption from Withholding on Compensation for Independent (& Certain Dependent) Personal Service of a Nonresident Alien Individual*

If a tax treaty between the United States and your country provides an exemption from, or a reduced rate of, withholding for certain items of income, filling out these forms allows you to claim such exemption by certifying that you are:

- A resident of a treaty country;

- The beneficial owner of the income;

For an easy-to-understand guide on which form to choose, please visit Sprintax or visit the IRS Guide For International Tax Payers.

If you are filling as an entity, not an individual, please visit the US Government's Internal Revenue Service Online and contact a tax advisor for assistance.

*According to the IRS, an alien is any individual who is not a U.S. citizen or U.S. national. A nonresident alien is an alien who has not passed the green card test or the substantial presence test.

Monthly earnings will be processed at the end of each month for work completed in the month prior via your payment method of choice. All users pay a 3.75% platform processing fee, and for specific payment methods there are fees.

| General | Fee |

| Platform Processing Fee Net-30 Net-10 Net-60 | 3.75% / Transaction 7% / Transaction 0% / Transaction |

| Payment Method | Fee per payment |

|---|---|

| ACH | USD 0.00 |

| Check | USD 0.00 |

| eCheck | USD 0.00 |

| PayPal (Non-US resident) | USD 1.00 + 2% Up to USD 21.00 |

| PayPal (US resident) | USD 1.00 + 2% Up to USD 2.00 |

| Wire Transfer (Non-US resident paid in non-USD) | USD 20.00 |

| Wire Transfer (Non-US resident paid in USD) | USD 26.00 |

| Wire Transfer (US resident) | USD 15.00 |

| Foreign Exchange Rate | Explained in platform upon selecting payment method |

You will be informed of the fees charged based on the payment method you select, before proceeding to the next step when setting up your payments profile.

The table below lists supported payment methods for each country using our payment provider.

- "T" refers to the date your payment is sent for execution by the bank.

- The value date (e.g., T to T+1) refers to the expected time by which the funds should arrive in your designated payment method.

- Thresholds change periodically, so use the following table as a general guideline.

Country | Wire Transfer | E-Check / Local Bank Transfer | Check | PayPal | Intercash |

|---|---|---|---|---|---|

| Afghanistan | USD (T to T+1) | USD | ✔ | ||

| Aland Islands | USD (T to T+1) | EUR (T+1 to T+2) | USD | ✔ | |

| Albania | USD (T to T+1) | ALL (T+2) | USD | ✔ | |

| Algeria | USD (T to T+1) | USD | ✔ | ✔ | |

| American Samoa | USD (T to T+1) | USD | ✔ | ||

| Andorra | EUR (T+1) USD (T to T+1) | USD | ✔ | ||

| Angola | USD (T to T+1) | USD | ✔ | ||

| Anguilla | XCD (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Antarctica | USD (T to T+1) | USD | ✔ | ||

| Antigua and Barbuda | XCD (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Argentina | USD (T to T+1/ T+2) | USD | ✔ | ✔ | |

| Armenia | AMD (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Aruba | AWG (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Australia | AUD (T+1) USD (T to T+1) | AUD (T+2 to T+3) Max 9,990,000 AUD | USD | ✔ | ✔ |

| Austria | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| Azerbaijan | USD (T to T+1) | USD | ✔ | ||

| Bahamas, The | BSD (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Bahrain | BHD (T+2) USD (T to T+1) | USD | ✔ | ✔ | |

| Bangladesh | BDT (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Barbados | BBD (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Belarus | USD (T to T+1) | USD | |||

| Belgium | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| Belize | USD (T to T+1) | USD | ✔ | ✔ | |

| Benin | XOF (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Bermuda | BMD (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Bhutan | USD (T to T+1) | USD | ✔ | ||

| Bolivia | BOB (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Bonaire | USD (T to T+1) | USD | ✔ | ||

| Bosnia and Herzegovina | USD (T to T+1) | BAM (T+2) | USD | ✔ | |

| Botswana | BWP (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Bouvet Island | NOK (T+2) USD (T to T+1) | USD | ✔ | ||

| Brazil | USD (T to T+1) | BRL (T+1 to T+2) Max 3,000 USD | USD | ✔ | ✔ |

| British Indian Ocean Territory | USD (T to T+1) | USD | ✔ | ✔ | |

| Brunei | BND (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Bulgaria | BGN (T+2) Min 1,030 USD EUR (T+2) USD (T to T+1) | BGN (T+2) EUR (T+1 to T+2)^ | USD | ✔ | |

| Burkina Faso | XOF (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Burundi | USD (T to T+1) | USD | ✔ | ||

| Cambodia | USD (T to T+1) | USD | ✔ | ||

| Cameroon | XAF (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Canada | CAD (T to T+1) USD (T to T+1) | CAD (T+2) USD (T+2) | USD | ✔ | ✔ |

| Cape Verde | CVE (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Cayman Islands | KYD (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Central African Republic | XAF (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Chad | XAF (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Chile | USD (T to T+1) | USD | ✔ | ✔ | |

| China | CNY (T to T+1) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Christmas Island | AUD (T+2) USD (T to T+1) | USD | ✔ | ||

| Cocos (Keeling) Islands | AUD (T+2) USD (T to T+1) | USD | ✔ | ||

| Colombia | USD (T to T+1) | USD | ✔ | ||

| Comoros | USD (T to T+1) | USD | ✔ | ||

| Cook Islands | NZD (T+2) USD (T to T+1) | USD | ✔ | ||

| Costa Rica | CRC (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Côte d'Ivoire | XOF (T+2) Min 1,030 USD USD (T to T+1) | USD | |||

| Croatia | HRK (T+2) Min 1,030 USD EUR (T+2) USD (T to T+1) | HRK (T+2) EUR (T+1 to T+2)^ | USD | ✔ | |

| Curaçao | ANG (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Cyprus | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| Czech Republic | CZK (T+1) EUR (T+1) USD (T to T+1) | CZK (T+2) EUR (T+1 to T+2)^ | USD | ✔ | |

| Denmark | DKK (T+1) EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| Djibouti | USD (T to T+1) | USD | ✔ | ||

| Dominica | XCD (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Dominican Republic | USD (T to T+1) | USD | ✔ | ✔ | |

| Ecuador | USD (T to T+1) | USD | ✔ | ✔ | |

| Egypt | EGP (T+2) Min 1,030 USD USD (T to T+1) | EGP (T+1) | USD | ✔ | ✔ |

| El Salvador | USD (T to T+1) | USD | ✔ | ||

| Equatorial Guinea | XAF (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Eritrea | USD (T to T+1) | USD | ✔ | ||

| Estonia | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| Ethiopia | USD (T to T+1) | USD | ✔ | ||

| Falkland Islands (Islas Malvinas) | USD (T to T+1) | USD | ✔ | ||

| Faroe Islands | DKK (T+2) USD (T to T+1) | USD | ✔ | ✔ | |

| Fiji | FJD (T+2) USD (T to T+1) | USD | ✔ | ✔ | |

| Finland | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| France | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| French Guiana | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2) | USD | ✔ | ✔ |

| French Polynesia | EUR (T+1) USD (T to T+1) | USD | ✔ | ✔ | |

| French Southern and Antarctic Lands | EUR (T+1) USD (T to T+1) | USD | ✔ | ||

| Gabon | XAF (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Gambia, The | USD (T to T+1) | USD | ✔ | ||

| Georgia | USD (T to T+1) | USD | ✔ | ✔ | |

| Germany | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| Ghana | USD (T to T+1) | USD | ✔ | ||

| Gibraltar | USD (T to T+1) | EUR (T+1 to T+2) | USD | ✔ | ✔ |

| Greece | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| Greenland | DKK (T+2) USD (T to T+1) | USD | ✔ | ✔ | |

| Grenada | XCD (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Guadeloupe | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2) | USD | ✔ | ✔ |

| Guam | USD (T to T+1) | USD | ✔ | ||

| Guatemala | USD (T to T+1) | USD | ✔ | ✔ | |

| Guernsey | GBP (T+1) USD (T to T+1) | USD | ✔ | ||

| Guinea | USD (T to T+1) | USD | ✔ | ||

| Guinea-Bissau | XOF (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Guyana | USD (T to T+1) | USD | ✔ | ||

| Haiti | USD (T to T+1) | USD | ✔ | ||

| Heard Island and McDonald Islands | AUD (T+2) USD (T to T+1) | USD | ✔ | ||

| Honduras | HNL (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Hong Kong | HKD (T+1) CNY (T+1) Min 1,030 USD EUR (T+1) USD (T to T+1) | HKD (T+3) Max 100,000,000 HKD | USD | ✔ | ✔ |

| Hungary | HUF (T+1) EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| Iceland | ISK (T+1) Min 1,030 USD USD (T to T+1) | EUR (T+1 to T+2) | USD | ✔ | |

| India | INR (T+1) USD (T to T+1) | INR (T+1) | USD | ✔ | |

| Indonesia | IDR (T+2) Min 1,030 USD USD (T to T+1) | IDR (T+2) Max 500,000,000 IDR | USD | ✔ | ✔ |

| Iraq | USD (T to T+1) | USD | ✔ | ||

| Ireland | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| Isle of Man | GBP (T+1) USD (T to T+1) | USD | |||

| Israel | ILS (T+1) USD (T to T+1) | ILS | USD | ✔ | ✔ |

| Italy | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| Jamaica | JMD (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Japan | JPY (T+1) USD (T to T+1) | USD | ✔ | ||

| Jersey | GBP (T+1) USD (T to T+1) | USD | |||

| Jordan | JOD (T+2) USD (T to T+1) | USD | ✔ | ✔ | |

| Kazakhstan | USD (T to T+1) | USD | ✔ | ✔ | |

| Kenya | KES (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Kiribati | AUD (T+2) USD (T to T+1) | USD | ✔ | ||

| Korea, South | KRW (T+2) Max 20,000 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Kuwait | KWD (T+2) USD (T to T+1) | USD | ✔ | ✔ | |

| Kosovo | EUR (T+1) USD (T to T+1) | USD | ✔ | ||

| Kyrgyzstan | USD (T to T+1) | USD | ✔ | ||

| Laos | USD (T to T+1) | USD | ✔ | ||

| Latvia | EUR (T+2) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| Lebanon | USD (T to T+1) | USD | ✔ | ||

| Lesotho | LSL (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Liberia | USD (T to T+1) | USD | |||

| Libya | USD (T to T+1) | USD | |||

| Liechtenstein | CHF (T+1) USD (T to T+1) | CHF (T+1) EUR (T+1 to T+2) | USD | ✔ | |

| Lithuania | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| Luxembourg | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| Macau | MOP (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Macedonia | USD (T to T+1) | USD | |||

| Madagascar | MGA (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Malawi | MWK (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Malaysia | MYR (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Maldives | USD (T to T+1) | USD | ✔ | ||

| Mali | USD (T to T+1) | USD | ✔ | ||

| Malta | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| Marshall Islands | USD (T to T+1) | USD | ✔ | ||

| Martinique | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2) | USD | ✔ | ✔ |

| Mauritania | USD (T to T+1) | USD | ✔ | ||

| Mauritius | MUR (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Mayotte | EUR (T+1) USD (T to T+1) | USD | ✔ | ||

| Mexico | MXN (T+1) USD (T to T+1) | MXN (T+2 to T+3) | USD | ✔ | ✔ |

| Micronesia, Federated States of | USD (T to T+1) | USD | ✔ | ||

| Moldova | USD (T to T+1) | USD | ✔ | ||

| Monaco | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2) | USD | ✔ | |

| Mongolia | USD (T to T+1) | USD | ✔ | ||

| Montenegro | EUR (T+1) USD (T to T+1) | USD | |||

| Montserrat | XCD (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Morocco | MAD (T+2) USD (T to T+1) | MAD (T+2 to T+3) Max 275,000 MAD | USD | ✔ | |

| Mozambique | USD (T to T+1) | USD | ✔ | ✔ | |

| Namibia | NAD (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Nauru | AUD (T+2) USD (T to T+1) | USD | ✔ | ||

| Nepal | NPR (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Netherlands | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| Netherlands Antilles | ANG (T+2) Min 1,030 USD USD (T to T+1) | USD | |||

| New Caledonia | EUR (T+1) USD (T to T+1) | USD | ✔ | ✔ | |

| New Zealand | NZD (T+2) USD (T to T+1) | NZD (T+2) | USD | ✔ | ✔ |

| Nicaragua | NIO (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Niger | XOF (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Nigeria | NGN (T to T+1) Min 1,030 USD* USD (T to T+1) | USD | |||

| Niue | NZD (T+1) USD (T to T+1) | USD | ✔ | ||

| Norfolk Island | AUD (T+2) USD (T to T+1) | USD | ✔ | ||

| Northern Mariana Islands | USD (T to T+1) | USD | ✔ | ||

| Norway | NOK (T+1) EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2) | USD | ✔ | |

| Oman | OMR (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Pakistan | PKR (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Palau | USD (T to T+1) | USD | ✔ | ✔ | |

| Palestinian authority | USD (T to T+1) | USD | ✔ | ||

| Panama | USD (T to T+1) | USD | ✔ | ✔ | |

| Papua New Guinea | PGK (T+2) USD (T to T+1) | USD | ✔ | ||

| Paraguay | PYG (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Peru | PEN (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Philippines | PHP (T+2) USD (T to T+1) | PHP (T+1) | USD | ✔ | ✔ |

| Pitcairn Islands | NZD (T+1) USD (T to T+1) | USD | ✔ | ||

| Poland | PLN (T+1) EUR (T+1) USD (T to T+1) | PLN (T+1) EUR (T+1 to T+2)^ | USD | ✔ | |

| Portugal | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| Puerto Rico | USD (T to T+1) | USD | ✔ | ||

| Qatar | QAR (T+2) USD (T to T+1) | USD | ✔ | ||

| Réunion | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2) | USD | ✔ | ✔ |

| Romania | RON (T+2) EUR (T+2) USD (T to T+1) | RON (T+1) EUR (T+1 to T+2)^ | USD | ✔ | |

| Russia | RUB (T+2) USD (T to T+1) | USD | ✔ | ||

| Rwanda | RWF (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Saint Barthélemy | USD (T to T+1) | USD | ✔ | ||

| Saint Helena | USD (T to T+1) | USD | ✔ | ||

| Saint Kitts and Nevis | XCD (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Saint Lucia | XCD (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Saint Martin (French part) | EUR (T+1) USD (T to T+1) | USD | ✔ | ||

| Saint Pierre and Miquelon | EUR (T+1) USD (T to T+1) | USD | ✔ | ||

| Saint Vincent and the Grenadines | XCD (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Samoa | WST (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| San Marino | EUR (T+1) USD (T to T+1) | USD | ✔ | ||

| São Tomé and Príncipe | USD (T to T+1) | USD | ✔ | ||

| Saudi Arabia | SAR (T+1) USD (T to T+1) | USD | ✔ | ✔ | |

| Senegal | XOF (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Serbia | RSD (T+1 to T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Seychelles | SCR (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Sierra Leone | USD (T to T+1) | USD | ✔ | ||

| Singapore | SGD (T+1) USD (T to T+1) | SGD (T+3) | USD | ✔ | ✔ |

| Sint Maarten (Dutch part) | USD (T to T+1) | USD | ✔ | ||

| Slovakia | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| Slovenia | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| Solomon Islands | SBD (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Somalia | USD (T to T+1) | USD | |||

| South Africa | ZAR (T+1) USD (T to T+1) | USD | ✔ | ✔ | |

| South Georgia and the South Sandwich Islands | USD (T to T+1) | USD | ✔ | ||

| Spain | EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| Sri Lanka | LKR (T+2) Min 1,030 USD USD (T to T+1) | LKR (T+2) | USD | ✔ | |

| Suriname | USD (T to T+1) | USD | ✔ | ||

| Svalbard | NOK (T+1) USD (T to T+1) | USD | ✔ | ||

| Swaziland | SZL (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Sweden | SEK (T+1) EUR (T+1) USD (T to T+1) | EUR (T+1 to T+2)^ | USD | ✔ | |

| Switzerland | CHF (T+1) EUR (T+1) USD (T to T+1) | CHF (T+1) EUR (T+1 to T+2) | USD | ✔ | |

| Tahiti | XPF (T+2) USD (T to T+1) | USD | ✔ | ||

| Taiwan | TWD (T+2) USD (T to T+1) | USD | ✔ | ✔ | |

| Tajikistan | USD (T to T+1) | USD | ✔ | ||

| Tanzania | TZS (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Thailand | THB (T+2) USD (T to T+1) | THB (T+2 to T+4) Max 50,000 THB | USD | ✔ | ✔ |

| Timor-Leste | USD (T to T+1) | USD | ✔ | ||

| Togo | XOF (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Tokelau | NZD (T+2) USD (T to T+1) | USD | ✔ | ||

| Tonga | TOP (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Trinidad and Tobago | TTD (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Tunisia | USD (T to T+1) | USD | ✔ | ||

| Turkey | TRY (T+2) USD (T to T+1) | TRY (T+1) Max 300,000 TRY | USD | ||

| Turkmenistan | USD (T to T+1) | USD | ✔ | ||

| Turks and Caicos Islands | USD (T to T+1) | USD | ✔ | ✔ | |

| Tuvalu | AUD (T+2) USD (T to T+1) | USD | ✔ | ||

| Uganda | UGX (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Ukraine | USD (T to T+1) | USD | |||

| United Arab Emirates | AED (T+2) USD (T to T+1) | USD | ✔ | ✔ | |

| United Kingdom | GBP (T+1) EUR (T+1) USD (T to T+1) | GBP (T+1 to T+3) | USD | ✔ | |

| United States | USD (T to T+1) | USD (T+1) | USD | ✔ | ✔ |

| United States Minor Outlying Islands | USD (T to T+1) | USD | ✔ | ||

| Uruguay | UYU (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ✔ | |

| Uzbekistan | USD (T to T+1) | USD | ✔ | ||

| Vanuatu | VUV (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Vatican City | EUR (T+1) USD (T to T+1) | USD | ✔ | ||

| Venezuela | USD (T to T+1) | USD | ✔ | ||

| Vietnam | VND (T+2) Min 1,030 USD USD (T to T+1) | VND (T+1 to T+3) Max 300,000,000 VND | USD | ✔ | ✔ |

| Virgin Islands (British) | USD (T to T+1) | USD | ✔ | ||

| Virgin Islands (US) | USD (T to T+1) | USD | ✔ | ✔ | |

| Wallis and Futuna | USD (T to T+1) | USD | ✔ | ||

| Western Sahara | USD (T to T+1) | USD | ✔ | ||

| Yemen | USD (T to T+1) | USD | |||

| Zambia | ZMW (T+2) Min 1,030 USD USD (T to T+1) | USD | ✔ | ||

| Zimbabwe | USD (T to T+1) | USD | |||

| * NGN wire transfers are supported only for Medcase users that are companies. Wires in NGN for individuals are not supported. | |||||

| ^ These countries support SEPA for eCheck. |

Tipalti is considered the world’s most powerful and professional payment platform designed to make your payment and payout experience as easy as possible.

It depends on the method of payment and the country of payment.

Usually, 3 business days is a good guess for payments to finish processing.

In addition, banking holidays may affect the value date assigned by the bank. PayPal and prepaid payments are not affected by banking business days. Sometimes, even when a payment finishes processing, it may take it a day or so to show up in your account.

If you require receipts/paystubs of your payments, please reach out to Support to request them.

The available currencies for payment differ per country and per payment method selected. Most of the major currencies across the world are available, including many local currencies. When you add your address and payment information in the Payments section, you can select a currency from the list of applicable currencies.

Please be aware that you are responsible for any transaction fees or foreign exchange rate fees incurred by selecting a given payment method or currency. When you select your payment method and currency, you will be notified of any possible fees.

If required information is missing or incorrect in your Payments area of your Medcase account, your payments will be deferred and not paid. We will send you an email to notify you of the deferred payment and why it was deferred.

We are required by law to collect your tax information for our own local reporting purposes in the US. We do not share this information with any third parties, nor do we report payments to any tax jurisdictions apart from our own in the US.

Payments are calculated based on either time worked on project or actions completed on project, according to the specific project terms in which you participate. The terms of each project will be clearly communicated to you prior to you accepting to work on any specific project.

DISCLAIMER: Medcase is not a tax advisor and is not authorized to provide tax advice. Any tax-related information posted in the Medcase Help Center is not intended nor should be construed as tax, legal or investment advice. If you have questions about tax-related issues, please consult with a tax professional.

Owners of Single Proprietor LLCs may have received an error message that their Tax Form cannot be verified. This is a simple fix and is due to discrepancies in how your LLC is classified in our payment system and on your tax forms.

If you file taxes as an Single Proprietor LLC and...

- Use your EIN to file taxes, please include ONLY your business entity name on your tax forms - do not write your name.

- Use your SSN to file taxes, please include BOTH your name and your business entity name on your tax forms.

In addition, please note that:

- Only EIN and SSN numbers are validated.

- If special characters are included in your legal name, Tipalti strips these characters and leaves only the ones permitted by the IRS. If your name does not match the name associated with the TIN at the IRS, then TIN validation fails and you will be "unpayable".

If any of the circumstances below occur and a payment sent through Tipalti is rejected or taken under compliance review, a rejection or review fee may be charged to Medcase by Tipalti. Should such a fee be charged, the related Medcase user(s) account balance shall be debited by the full amount of any such fee(s):

- A user provides incorrect or invalid payee details, including but not limited to SWIFT number, routing number, bank account number, PayPal account information, and/or check information

- A payee’s bank and/or PayPal rejects any payment(s) due to reasons specific to the payee’s geographic region

- A payee triggers an Anti Money Laundering (AML) and/or Office of Foreign Assets Control (OFAC) review

- Any reason outside of the control of Medcase

For international accounts, we strongly recommend that you reach out to the receiving institution to ensure your account is able to receive payments in your selected method and that your account is in good standing.

Fee Schedule

| Wire Investigations | $25.00 each |

| US ACH Return Fee | $11.00 each |

| eCheck Return Fee | $25.00 each |

| Wire Return Fee | $25.00 each |

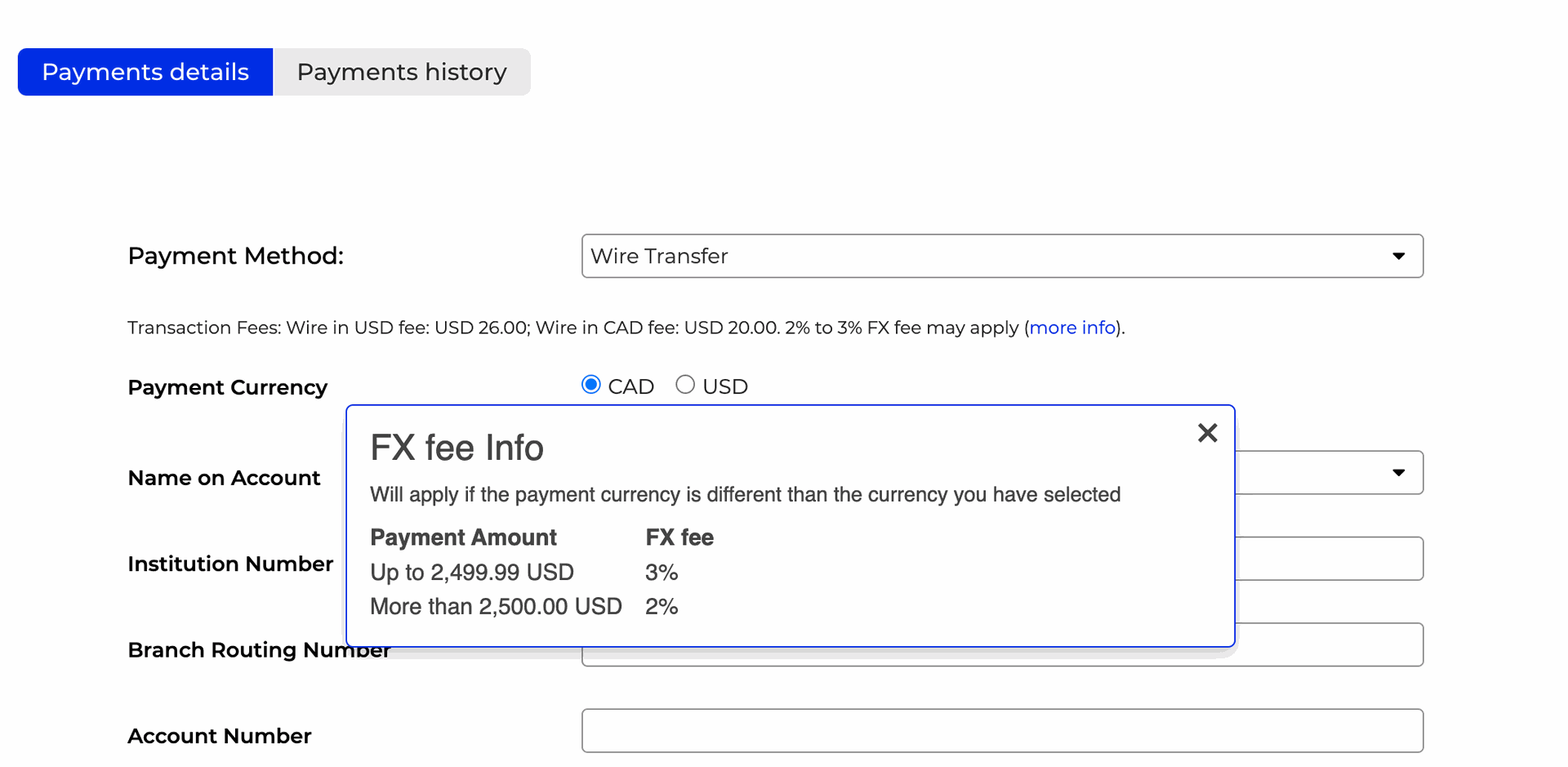

Once you start filling in the payment information in your Medcase Account and select your desired payment method, you will be notified of any transaction fees or foreign exchange rate fees incurred by selecting that payment method and their rates inside the platform. See an example below.

In practice, your payment amount is converted to your selected currency on the day of transfer using the bank's conversion rate. Foreign exchange fees are then applied.

W-9

You should complete the W-9 form if you are an individual or your entity is incorporated in the US and one of the following applies:

- You are a US citizen.

- You are a resident of the US.

- You have dual citizenship with one citizenship being US.

- You are subject to taxation as a US citizen.

- You were born in the US and have not formally renounced US citizenship.

The W-9 form can be completed online in the Medcase payment portal.

W-8BEN

You should complete the W-8BEN form if the you are an individual who is not:

- A US citizen

- A resident of the US

- Subject to taxation as a US citizen

- US born

And who:

- Has no income effectively connected with the conduct of trade or business within the US

- Is not acting as Intermediary

- Is not receiving a compensation for personal services performed in the US for which you are claiming a treaty benefit

The W-8BEN form can be completed online in the Medcase payment portal. Instructions on how to complete this form are provided.

P.O. box or in-care-of (c/o) addresses are not accepted on this tax form.

W-8BEN-E

Non-US entities that have US-sourced income are required to complete a W-8BEN-E form. This form can be completed online in the Medcase payment portal. Instructions on how to complete the form are provided.

If you enter a P.O. box or in-care-of (c/o) address on this tax form, you will be required to provide evidence of the registered address and an explanation to confirm it is the only address for the entity (see Additional Documents).

W-8ECI

You need to complete the W-8ECI form if you are an individual and your income is effectively connected with the conduct of trade or business within the US (email support@medcase.health for W-8ECI withholding rates). The W-8ECI form and instructions on how to complete the form are provided to you in the Medcase Payment Portal. This form must be downloaded, completed manually and uploaded back to the Medcase Payment Portal or Supplier Hub, depending on the access that was given to you.

W-8IMY

You need to complete a W-8IMY form if you are an entity classified as a foreign partnership, a foreign simple trust or a foreign grantor trust (and not claiming treaty benefits) or the you are an individual acting as Intermediary. The W-8IMY form and instructions on how to complete the form are provided to you in the Medcase Payment Portal. This form must be downloaded, completed manually and uploaded back to the Medcase Payment Portal or Supplier Hub, depending on the access that was given to you.

W-8EXP

You need to complete the W-8EXP form if you represent a foreign government, an international organization, a foreign central bank of issue, a foreign tax-exempt organization, a foreign private foundation or government of a US possession claiming the applicability of sections 115(2), 501(c), 892, 895 or 1443(b); and, the following applies:

- You are not an individual.

- You are not an entity incorporated in the US.

- You are not an entity that is a foreign partnership, a foreign simple trust or a foreign grantor trust (and not claiming treaty benefits).

- Your entity's income is not effectively connected with the conduct of trade or business within the US.

The W-8EXP form and instructions on how to complete the form are provided to you in the Medcase Payment Portal.This form must be downloaded, completed manually and uploaded back to the Medcase Payment Portal or Supplier Hub, depending on the access that was given to you.

8233

You need to complete an 8233 form if you are receiving compensation for personal services performed in the US for which you are claiming a treaty benefit. The 8233 form and instructions on how to complete the form are provided to you in the Medcase Payment Portal.This form must be downloaded, completed manually and uploaded back to the Medcase Payment Portal or Supplier Hub, depending on the access that was given to you.

At Medcase, payments depend on a variety of factors, such as the type and amount of projects you're working on, your worked hours, finished tasks, and so on. We are implementing a minimum payment threshold of $100 for all clinicians working on our platform. If your payment for a given month falls under this threshold, you can still be paid, but you will be contacted by either your PM or Support in order to inquire if you'd like this payment right away, or if you'd prefer to merge it with next month's payment. Do keep in mind that there is a transaction fee incurred with every payment, so a single transaction's fee will absorb less percent of the total payment than doing more than one transaction.

Yes, you can switch your selected payment method at any time by editing the information in your Tipalti Payment profile. Any changes will take effect during the next payment cycle.

Your payments are secured and processed by Tipalti, our payments processing partner.

Upon filling out your payment details and chosen method, your sensitive banking information will be submitted over an encrypted SSL connection with enterprise-grade security that ensures your payment information is safely maintained at the highest security level available. Tipalti is secured and verified by Geo Trust and is PCI compliant, meaning your sensitive information is stored on an isolated, secure server.

If you select local bank transfer / eCheck as your payment method, you are required to provide your Bank Code and Branch Code. If your bank does not support Bank Codes or Branch Codes, you will not be able to continue the payments form.

To solve this, you will need to choose an alternate payment method, such as the Wire Transfer option which does not require a local bank code or branch code.

In certain countries, there may be errors or payment issues when choosing specific payment methods. In this article we outline the common problems encountered and their solution:

Worldwide

When inputting your payment details, please double-check and make sure you're putting the correct bank numbers, routing codes, email addresses and so on. Otherwise, even if your payment method is accepted and says it is able to receive payments, payments sent to it will result in an error. Usually, it says "unable to find bank / incorrect routing number / unable to locate account / PayPal details are not valid / etc". In such an instance, you will receive an error email and will be prompted to edit your details.

Canada

Using ACH: ACH is for US-based banks only. If you want to use this payment method, you have to check with your bank to know if they can provide a U.S ACH routing code to use. If not, then this payment method cannot be used; even if at first it seems like the payment method is correct and usable, payments will end up rejected. We recommend selecting Wire Transfer or PayPal.

India

Using eCheck: Although rare, sometimes, choosing eCheck may result in payment errors for accounts in India. Even if you have been receiving eChecks without issue before, the problem may show up later on. This is a platform bug and for the time being, there is nothing that can be done about it. If the error occurs, we recommend choosing PayPal or Wire.

If you encounter any issue during the process to update your payment details or if there are any discrepancies in your payment, please contact Support.